Introduction: Understanding Bitcoin’s Impact in Vietnam

As of 2024, Vietnam has emerged as a vibrant hub for cryptocurrency, with a remarkable percentage of its population actively engaging in digital asset trading. The Bitcoin trading volume in Vietnam has substantially increased, reaching unprecedented levels. What drives this surge? With over 4.1 billion dollars lost to DeFi hacks in 2024, understanding Bitcoin’s trading landscape becomes crucial for investors and regulators alike. In this article, we will explore the trends, challenges, and insights surrounding Bitcoin trading volume in Vietnam and its implications in the broader context of blockchain security standards and practices.

Understanding Bitcoin Trading Volume

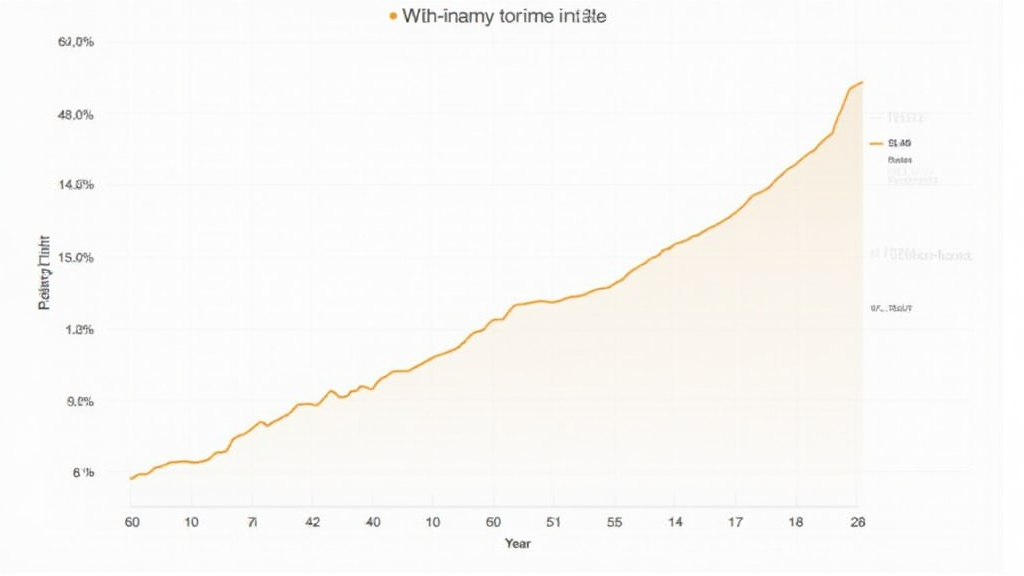

Bitcoin trading volume refers to the total amount of Bitcoin that is traded on exchanges during a specific period. This metric is crucial in evaluating the health and liquidity of the cryptocurrency market. In Vietnam, the trading volume has seen exponential growth, with factors such as increased internet penetration, a tech-savvy population, and the rising interest in decentralized finance (DeFi) being key drivers.

The Rise of Bitcoin Trading in Vietnam

- Increased Adoption: Vietnam has witnessed significant growth in crypto adoption, with around 20% of the population owning cryptocurrency assets.

- Innovation in Payment Methods: Companies like Mobile Money and Zalo Pay are facilitating easy access to Bitcoin trading.

- Government Stance: Although regulations are still evolving, a clearer framework is boosting investor confidence.

Current Trends in Bitcoin Trading Volume

Analyzing the current Bitcoin trading landscape in Vietnam reveals several noteworthy trends. This section will delve into specific metrics and data patterns.

1. Anonymous Trading and Its Implications

A considerable percentage of Bitcoin trades in Vietnam occur anonymously. While this appeals to privacy-conscious users, it poses challenges for regulators. Here’s a snapshot:

- Approximately 38% of trades are carried out on peer-to-peer (P2P) platforms.

- Call for improved compliance standards to enable transparency, i.e., tiêu chuẩn an ninh blockchain.

2. Market Volatility

The cryptocurrency market is notoriously volatile. During the first quarter of 2024, Bitcoin experienced fluctuations leading to a trading volume increase of over 150%. Lessons learned from these shifts highlight the need for robust risk assessment and management.

Challenges Facing Bitcoin Trading in Vietnam

Despite the successes, several challenges continue to loom over the cryptocurrency market in Vietnam.

1. Regulatory Uncertainty

- The lack of established regulations affects investor confidence.

- Ongoing discussions regarding tiêu chuẩn an ninh blockchain could pave the way for future frameworks.

2. Security Concerns

With the surge in trading volume, security is a top priority. Cases of hacking and fraud have been reported frequently. Implementing hardware wallets like the Ledger Nano X can significantly reduce risks, with studies showing a 70% decrease in successful hacks among users.

The Future of Bitcoin Trading Volume in Vietnam

The trajectory for Bitcoin trading in Vietnam appears promising. With an increase in user educational programs and regulatory frameworks being developed, the market is expected to continue growing.

1. Predictive Analysis: What’s Next?

Analysts predict that by 2025, Bitcoin trading volume in Vietnam could match or surpass that of other emerging markets in Southeast Asia.

- Innovative Adoption: Expect more innovative financial products targeting crypto investors.

- Regulatory Improvements: Governments may establish detailed standards to protect investors.

2. The Role of Education in the Crypto Sphere

Education and awareness remain vital. Organizations must develop training programs to help newbies understand the complexities of trading, such as how to audit smart contracts.

Conclusion: The Road Ahead for Bitcoin Trading Volume in Vietnam

Bitcoin trading volume in Vietnam reflects a vivid picture of growth, challenges, and potential. As we navigate through 2024, investors and stakeholders must advocate for stronger regulatory frameworks and security protocols to ensure the market’s longevity and credibility.

In conclusion, understanding Bitcoin trading volume is essential not just for investors but also for regulators aiming to establish a balanced crypto landscape in Vietnam. As we move towards a decentralized future, let’s ensure our approach to trading is informed, secure, and compliant.

For a deeper dive into the intricacies of Bitcoin trading in Vietnam, explore more resources at HIBT.com.

About the Author: Dr. Tran Hoang, a blockchain consultant and educator, has published over 15 papers on digital currencies and blockchain technology. He has led audits for several prominent projects in the crypto space.