Introduction

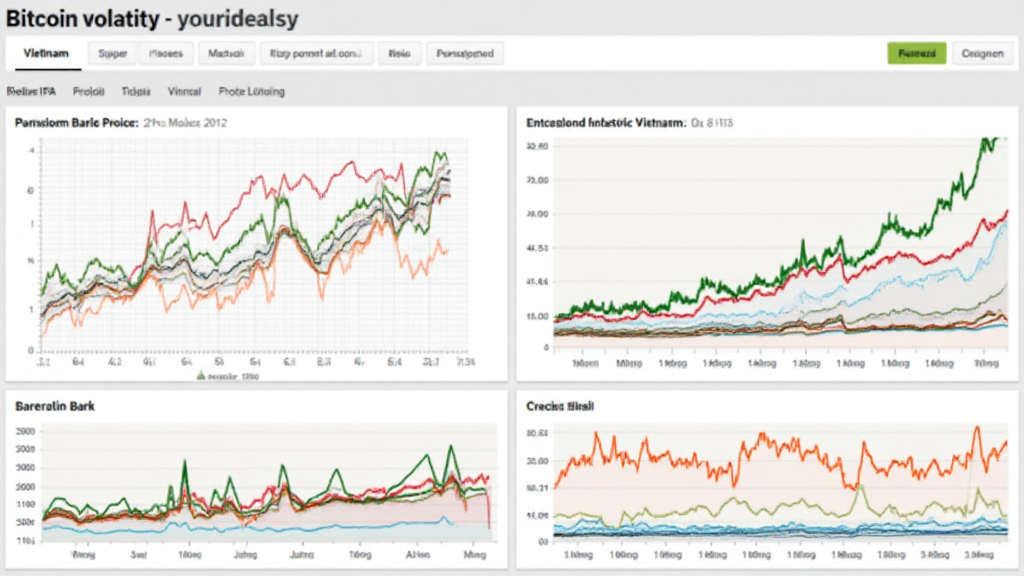

Bitcoin’s price volatility has been a topic of considerable discussion, especially in emerging markets like Vietnam. With the rapid rise of cryptocurrency adoption in the country, understanding the factors that influence Bitcoin’s fluctuations is more critical than ever. In 2022, Vietnam saw a staggering increase in cryptocurrency users, with reports indicating a growth rate of over 40% compared to the previous year. This explosive growth can be attributed to the rising interest among young entrepreneurs and tech enthusiasts in Vietnam, further fueled by a surge in global interest in digital currencies.

This article aims to delve into the complexities of Bitcoin price volatility in Vietnam, addressing the various factors at play, local market dynamics, and potential strategies for investors looking to navigate these turbulent waters. We’ll also highlight some common misconceptions surrounding Bitcoin and provide actionable insights for those interested in participating in this vibrant market.

Dynamics of Bitcoin Price Volatility

So, what exactly drives the volatility of Bitcoin’s prices? Let’s break it down:

- Market Sentiment: Investors’ emotions often guide market movements. A sudden influx of news can shift perceptions and trigger rapid buying or selling.

- Speculation: High levels of speculation can lead to drastic price movements, as investors react to market rumors or anticipated events.

- Regulatory Developments: In Vietnam, regulatory news can have a swift impact on prices, whether positive or negative.

External Factors Affecting Bitcoin Prices

The global economic environment significantly impacts Bitcoin prices. To illustrate:

- Interest Rates: When central banks increase interest rates, investors might pull their money from high-risk assets like Bitcoin, leading to price drops.

- Economic Indicators: Economic downturns can cause investors to flee to traditional safe havens, causing Bitcoin to become bearish.

- Technological Advances: Innovations in blockchain technology can positively influence Bitcoin’s market dynamics.

Local Market Trends in Vietnam

Vietnam’s unique position within the cryptocurrency landscape deserves attention. With a young population and high levels of internet penetration, the nation has emerged as a significant player in the crypto realm. Recent surveys revealed that around 25% of Vietnamese individuals are likely to consider investing in cryptocurrencies, particularly Bitcoin.

The demand for Bitcoin in Vietnam is also driven by:

- Remittances: Many Vietnamese use Bitcoin for international remittances, appreciating its lower transaction fees compared to traditional methods.

- Investment Opportunities: Young investors in Vietnam often seek to diversify their portfolios with cryptocurrencies, seeing Bitcoin as a modern asset class.

The Role of Social Media and Information Access

Social media plays a pivotal role in shaping investment decisions among Vietnamese investors. Platforms like Telegram and Facebook are rife with trading signals and influential voices that can drive immediate market reactions.

Moreover, the availability of local Vietnamese resources on Bitcoin trading and analysis allows new investors to gain insights without needing extensive financial knowledge. As content in Vietnamese grows, so does the demand for informed trading practices.

Strategies for Navigating Bitcoin Volatility in Vietnam

For those looking to invest in Bitcoin amidst its volatility, the following strategies can be beneficial:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount regularly, helping investors avoid the pitfalls of timing the market.

- Staying Informed: Regularly updates on both local regulatory developments and global Bitcoin trends is crucial for making informed trading decisions.

- Risk Management: Understanding one’s risk tolerance is essential. Setting stop-loss orders can help mitigate potential losses.

Utilizing Local Exchanges

Vietnam hosts several reliable cryptocurrency exchanges, facilitating local trades with minimal fees. Popular exchanges include Binance and Remitano, which offer tailored services for Vietnamese users.

When choosing an exchange, consider factors such as:

- User experience

- Security measures

- Customer support

The Future of Bitcoin in Vietnam

As Vietnam continues to embrace cryptocurrencies, the future looks promising. According to a report by hibt.com, the Vietnamese crypto market is projected to reach $1 billion by 2025, with Bitcoin leading the charge as a preferred digital asset.

The ongoing technological advancements, paired with a supportive young demographic, position Vietnam as one of the potential hotspots for cryptocurrency growth in Southeast Asia.

Conclusion

Bitcoin price volatility in Vietnam is both a challenge and an opportunity for investors. Understanding the local market dynamics, being informed on global trends, and adopting sound investment strategies can significantly enhance an investor’s chances of success in this exciting arena.

If you’re looking to dive into the world of cryptocurrencies, leverage your market knowledge wisely, and always remain aware of the inherent risks involved. At beginnercryptoguide, we urge you to stay informed and make decisions that align with your financial goals.

Meet Our Expert

Dr. An Nguyen, a leading authority in blockchain technology, has published over 15 papers on cryptocurrencies and led audits on two major blockchain projects. Dr. Nguyen’s insights into Bitcoin and its implications in developing economies like Vietnam provide invaluable perspectives for both new and seasoned investors.